Healthcare Plan Summary

Eligibility for RHCT benefits has changed as of January 1, 2018. Please click this link to review the changes.

Medical, Prescription Drug and Dental Coverage for Retirees/Disabled Pensioners/Surviving Spouses

Introduction

The Chicago Transit Authority Retiree Healthcare Trust ("RHCT") was established in 2008 to provide and administer health care benefits for eligible Chicago Transit Authority ("CTA") retirees and their dependents and survivors.

Benefits provided by the RHCT through the CTA Retiree Healthcare Plan (the "Plan") currently consist of:

- Medical coverage (including prescription drug); and

- Dental coverage.

Information about available benefits is contained in the Enrollment Guide, which is available at www.ctaretirement.org or by calling Group Administrators, the Plan's third party administrator, at 1-(866)-997-3821.

This Plan Summary ("Summary") briefly describes the general administrative features of the Plan and your rights and obligations under the Plan as of October 1, 2011. Basic information about the benefits offered may be found in the Enrollment Guide. Each of the benefits is described more thoroughly in a separate certificate of coverage or benefit summary distributed by each benefit provider, such as Aetna or BlueCross and BlueShield (each a "Benefit Booklet"). If you do not have your provider's Benefit Booklet, you should contact your benefit provider or Group Administrators, the Plan's third party administrator, for a copy. Contact information for benefit providers is listed in the Enrollment Guide. Contact information for Group Administrators is listed in the Enrollment Guide and the Contact Information section at the end of this Summary. Benefit booklets are also available at www.ctaretirement.org.

The term "you" in this Summary refers to the former CTA employee who is eligible for benefits under the Plan. This term also refers to a former CTA employee's eligible surviving spouse.

The term "spouse" in this Summary refers to the legally married spouse, civil union partner, or same-sex domestic partner of an eligible retiree. The term "surviving spouse" in this Summary refers to the spouse of a deceased retiree. See the Eligible Dependents section for the eligibility rules for spouses.

The term "Plan Administrator" in this Summary refers to the Board of Trustees of the RHCT.

Resolution of Conflict Between Documents

In the event of any inconsistencies between this Summary and any Benefits Booklet, the Summary shall control in describing eligibility and the Benefits Booklet shall control in describing the benefits provided. In the event of any inconsistencies between this Summary and the Trust Agreement or Bylaws or other governing Plan document, the Plan Administrator has discretionary authority to resolve such conflicts, and its determination will be binding. However, in no event shall the terms of this Summary override the terms of Illinois Public Act 95-0708, as amended.

As explained in the Amendment and Termination section, the Board of Trustees of the RHCT reserves the right to modify, amend or terminate the Plan at any time. Therefore, you do not become entitled to any vested benefits under this Plan.

Eligibility

The Plan provides health benefits for retirees and their dependents who meet the eligibility requirements as described in this Eligibility section. If eligible, you MUST enroll and select coverage in order to receive benefits from the Plan.

Eligible Retirees

You, as a former CTA employee, are eligible to enroll for health care coverage under the Plan if you satisfy one of the following three sets of requirements:

- You are receiving a pension from the Retirement Plan for CTA Employees ("CTA Retirement Plan") and:

- Under the 55/20 rule: You separated from service with the CTA at or after age 55 with at least 20 years of Eligibility Service; or

- As a deferred participant: You separated from service with the CTA before age 55 with at least 20 years of Eligibility Service and are at least age 65 at the time you enroll; or

- Under the 25 and Out rule:

- You had at least 25 years of Eligibility Service and retire from the CTA no later than the day prior to the execution of the next collective bargaining agreement between the CTA and Amalgamated Transit Union Locals 241 and 308, after the one which expires on December 31, 2011;

- If you retire with a 25 and Out pension after the next collective bargaining agreement is signed, you must wait until age 55 to be eligible for RHCT benefits, and demonstrate prior creditable coverage.

- You are receiving a disability allowance from the CTA Retirement Plan.

- You are not entitled to a pension from the CTA Retirement Plan because of your extended period of employment in a temporary or part-time employment classification, but you contributed to the RHCT as a CTA employee, and

- You are at least age 55 with 20 years of Eligibility Service when you separate from service with the CTA; or

- You separated from service with the CTA before age 55 with at least 20 years of Eligibility Service and are at least age 65 at the time you enroll.

You must enroll for coverage and pay the required monthly premium in a timely manner to receive benefits from the Plan. See Enrolling for Coverage for more information. Note: You may not enroll for coverage if you opt out of participating in, or receive a refund of your contributions from, the CTA Retirement Plan.

If you applied for a pension from the CTA Retirement Plan on or before October 21, 2010, and started receiving pension benefits on or before December 1, 2010, the rules were different. If you have questions about eligibility, please contact Group Administrators at 1-866-997-3821.

Eligibility Service

Your years of Eligibility Service are equal to:

- Your credited years of service under the CTA Retirement Plan through January 17, 2008;

PLUS - Your years of continuous service with the CTA from January 18, 2008 (or, if later, the date you began working for the CTA) through the date you separate from service.

Eligibility Service is determined using the time that elapses from your hire date to the date you separate from service. It is based upon completed full years of service, without rounding. For example, if under (1) and (2) above you have a total of 19 years and 7 months of service, your service will not be rounded up to 20 years of Eligibility Service.

Eligible Dependents

You can also cover your eligible dependents under the Plan. You must be enrolled in a medical coverage option to enroll your eligible dependents. You do not need to elect dental coverage to enroll your dependents in a dental coverage option.

Eligible Spouse

The term "spouse" under the Plan refers to your married spouse, your same-sex domestic partner, a person with whom you have a civil union, or your surviving spouse, if he or she meets the eligibility requirements described in this section. The following rules apply to all persons included in the term "spouse":

- If your spouse is enrolling in the Plan after July 1, 2009, your spouse is eligible if he or she was your spouse for at least one year prior to the date of your separation from employment with the CTA and that relationship has continued since that date without interruption.

- If you dissolve your spousal relationship, your spouse will lose eligibility as of the last day of the month of the date of dissolution. You must notify Group Administrators as described in the Notification of Dependent's Loss of Eligibility section.

- Your spouse must satisfy the eligibility requirements for the appropriate subcategory of spouse as described below.

Married Spouse

A married spouse is someone with whom you have a legal marriage recognized by the State of Illinois.

Party to a Civil Union

If you and your partner are parties to a civil union as defined by Illinois Public Act 096-1513, your partner will have the same rights under the Plan as a married spouse.

Domestic Partner

A same-sex domestic partner is eligible for coverage as a spouse provided you and your partner meet all the following conditions:

- You are each other's sole domestic partner, responsible for each other's common welfare, and

- Neither of you is married, and

- You are not related by blood closer than would bar marriage in the State of Illinois, and

- You are each at least eighteen (18) years of age, and both of you are the same sex, and reside at the same residence, and

- You have been residing together for at least 12 months prior to enrolling for coverage, and

- Both of you have completed, signed and submitted the Affidavit of Domestic Partnership; and

- At least TWO of the following three conditions (1-3) apply:

- You and your partner have common or joint ownership of a residence (provide a copy of your mortgage or lease).

- You and your partner have at least two of the following arrangements:

- Joint ownership of a motor vehicle;

- A joint credit account (e.g., credit card);

- A joint checking account;

- Your domestic partner is identified as a primary beneficiary in your will.

Surviving Spouse

"Surviving Spouse" refers to the married spouse, civil union partner or domestic partner of a deceased former CTA employee eligible for benefits under the Plan. Your surviving spouse is eligible for coverage if, at the time of your death, you and your spouse were both eligible for coverage, even if not enrolled. Your surviving spouse also is eligible for coverage if he or she is receiving a survivor annuity from the CTA Retirement Plan.

Your surviving spouse, if NOT already enrolled in the Plan at the time of your death, may enroll the first day of the month following the date of your death (or, if later, the date he or she begins receiving a survivor annuity from the CTA Retirement Plan). Alternatively, your surviving spouse may opt out and enroll later if he or she has coverage elsewhere. See the section Opting Out of Coverage, for more information.

If your surviving spouse enrolls for coverage, he or she may enroll your eligible children as well. If your surviving spouse remarries, becomes party to a civil union or establishes a domestic partnership, your surviving spouse will lose eligibility for any future benefits through the Plan.

Eligible Child

Your child is eligible if your child is:

- Your natural, adopted (or placed for adoption) or stepchild through age 25, who:

- Is unmarried;

- Resides with you (if the child is age 19 or older)*; and

- Is dependent upon you for over half of his or her financial support.

- Your natural, adopted (or child placed with you for adoption) or stepchild through age 29, who is a military veteran and:

- Is an Illinois resident;

- Is unmarried;

- Has served in the U.S. Armed Forces (including the National Guard);

- Has received a release or discharge other than a dishonorable discharge;

- Resides with you when not deployed; and

- Is dependent upon you for over half of his or her financial support.

- Birth certificate;

- Adoption papers;

- Certificate of marriage or civil union.

- A child named as an alternate recipient in a child support order, if the Plan Administrator determines the support order to be a Qualified Medical Child Support Order ("QMCSO"). You may contact Group Administrators to obtain a free copy of the Plan's QMCSO procedures.

- A dependent child of any age who was disabled prior to age 26 and who, due to disability:

- Is incapable of self-sustaining employment;

- Is dependent upon the retiree or other care provider for lifetime care and supervision because of the disability; and

- Was covered under the Plan when he or she reached age 26.

Enrolling for Coverage

Enrolling When First Eligible

If you are eligible, you may enroll for health care coverage at the time you apply for a pension or a disability allowance from the CTA Retirement Plan or otherwise meet the eligibility requirements. If you have medical insurance coverage from another source, such as your spouse's employer, you can delay enrolling for coverage under this Plan until you lose the other coverage. See the following section, Opting Out of Coverage, for information about continuing your eligibility and enrolling in the Plan later. If you enroll at the time you are applying for benefits from the CTA Retirement Plan, your coverage under the Plan will begin on the first day of the month that your CTA Retirement Plan benefit is payable.

Opting Out of Coverage

If you have medical insurance coverage from another source, such as with your new employer or your spouse's employer, you can delay enrolling for coverage under this Plan until you lose the other coverage. This is referred to as "opting out" of coverage.

Each eligible person (retiree, spouse or dependent child) may opt out of coverage or drop coverage and later enroll in the Plan once after January 1, 2010. However, any person who opts out of or drops coverage and then enrolls in the Plan must provide a Certificate of Creditable Coverage showing that they were covered under another medical plan immediately prior (within 63 days) to having coverage under this Plan. Coverage will begin on the first day of the month following Group Administrators' receipt of a completed enrollment form and the applicable premium.

Each person who opts out will have only one opportunity to return to the Plan after January 1, 2010. If you return to the Plan and then opt out of coverage again, you will permanently lose your eligibility for Plan benefits.

For purposes of applying these opt out rules, only enrollment in the Plan's medical coverage options are considered. Dental insurance coverage enrollment changes are disregarded.

Changing Your Healthcare Elections: During Annual Open Enrollment

Once you enroll, your coverage will be effective for the remainder of that calendar year. You will have the opportunity to change your elected options annually. Annual open enrollment allows you to change the dependents you cover, your medical coverage option and your dental coverage (for those under age 65). Your choices will be effective the next calendar year (January 1 – December 31).

Changing Your Healthcare Elections: Outside of Annual Open Enrollment

Outside of annual open enrollment, you or your dependents will be allowed to change your health care elections only if you have a qualifying event and the requested change is consistent with that event or you want to drop coverage for yourself or your dependents. Examples of qualifying events include, but are not limited to, the following:

- You involuntarily lose coverage under another plan. You will be allowed to enroll yourself and any eligible dependents who were covered under the other plan.

- Your eligible spouse and/or dependent child(ren) involuntarily lose coverage under another plan. You will be allowed to add the dependent(s) and change to family coverage if necessary.

- You become eligible for Medicare. You should also enroll in Medicare Parts A and B.

- Your eligible spouse (if you are a retiree) or dependent child(ren) becomes eligible for Medicare. They should also enroll in Medicare Parts A and B.

- You die. Your surviving spouse will be able to convert to surviving spouse coverage, either with or without eligible dependents.

- Your dependent is no longer eligible for coverage or dies. You may change your level of coverage from family to single.

- You or your spouse gives birth to or adopts a child. You will be allowed to add the child as a dependent and change to family coverage if necessary. See the section Adding a New Child on page 9 for more information.

- You or your dependent experience a Medicaid/CHIP Enrollment Event. A "Medicaid/CHIP Enrollment Event" occurs on the date that either (i) you or your dependent's coverage under Medicaid or a State child health insurance plan terminates as a result of the loss of eligibility for such coverage, or (ii) you or your dependent is determined to be eligible for premium assistance under Medicaid or such a State child health insurance plan.

You or your dependent(s) must notify Group Administrators within 30 days of the qualifying event (60 days in the case of a Medicaid/CHIP Enrollment Event) to be able to change your health care elections. Anyone wishing to enroll in a medical coverage option at any time after he or she was first eligible to do so also must provide documentation (a Certificate of Creditable Coverage) showing that he or she was covered under another qualifying medical plan immediately prior to the date he or she enrolls for medical coverage under this Plan.

If you or your dependent(s) do not experience a qualifying event, you will only be allowed to change your health care elections during the next annual open enrollment period, for coverage effective the following January 1.

You or your dependents may drop coverage under the Plan at any time. If you drop coverage, it will end on the last day of the month in which Group Administrators received notice or for which the applicable premium payment was received, whichever is earlier.

Certificate of Creditable Coverage

If you have coverage under another plan, that group health plan or health insurance issuer should provide you a Certificate of Creditable Coverage, free of charge, when:

- You lose coverage under that plan;

- You become entitled to elect COBRA continuation coverage; or

- Your COBRA continuation coverage ceases.

You must request the Certificate of Creditable Coverage when you lose your other plan coverage or your COBRA continuation coverage ceases. Without evidence of creditable coverage, you will not be eligible to enroll for coverage under this Plan unless you are enrolling when you are first eligible for coverage.

Creditable Coverage Defined - Health coverage of an individual under: an employer-sponsored group health plan (including while on COBRA continuation coverage), individual health insurance policy, Medicare, Medicaid, a state health benefits risk pool, a public health plan, and certain other health programs for which coverage is considered creditable under the Health Insurance Portability and Accountability Act ("HIPAA").

Adding a New Child

If you, as a retiree (and not as a surviving spouse), add a new dependent child (due to birth, adoption or placement for adoption), you must notify Group Administrators within 30 days of the birth, adoption or placement for adoption. You must supply all the necessary documentation, such as a copy of the certified birth certificate or adoption papers, to Group Administrators. If you do not inform Group Administrators of your new dependent child and provide the required documentation in a timely manner, you will have to wait until the annual open enrollment to enroll the child. Please see the sections Opting Out of Coverage and Changing Your Healthcare Elections for additional information.

Loss of Coverage

Retiree's Loss of Coverage

You and your dependents will lose coverage under the Plan at 12:01 a.m. on the first day of the month following the first of these events to occur:

- Your monthly premium is not received by Group Administrators within the grace period for late payments;

- You die, except as provided under the Surviving Spouse section; or

- The RHCT no longer provides benefits.

Dependent's Loss of Coverage

Your dependent(s) will lose coverage under the Plan at 12:01 a.m. on the first day of the month following the first of these events to occur:

- You, as the retiree, lose coverage as listed above;

- You remove your dependents from your coverage;

- Your monthly premium for family coverage is not received by Group Administrators within the grace period for late payments;

- Your dependent no longer meets all the requirements needed for eligibility, such as:

Failure to notify Group Administrators within 60 days can have serious consequences.

- You and your spouse dissolve your relationship;

- Your surviving spouse remarries;

- Your child reaches the maximum age, gets married, ceases to be dependent upon you or otherwise ceases to satisfy the criteria described in the Eligible Child section; or

- Your dependent dies.

Notification of Dependent's Loss of Eligibility

If a dependent loses eligibility because he or she no longer satisfies the conditions required by the Plan as described in the Eligible Dependents section, you must notify Group Administrators within 60 days of the loss of eligibility.

If you fail to notify Group Administrators within 60 days of the loss of eligibility, you may be subject to any or all of the following consequences:

- Retroactive termination of coverage for your dependent to the date of loss of eligibility;

- Repayment of benefits paid by the Plan for your dependent after the loss of eligibility;

- Prosecution for fraud by filing claims for a person not eligible for the Plan.

Continuation Coverage

If a dependent loses eligibility because he or she no longer satisfies the conditions required by the Plan as described in this Eligible Dependents section, he or she may be eligible for continuation coverage, as further described in the Additional Plan Provisions section.

Benefits

For information about medical and dental coverage options, please refer to the Enrollment Guide and Benefits Booklets, which are available at www.ctaretirement.org or by calling Group Administrators at 1-866-997-3821. Detailed information about each medical and dental coverage option may be found in the applicable Benefits Booklet.

Please read the applicable Benefits Booklet carefully for important information about how the Plan interacts with Medicare.

Monthly Premiums

Premium Payments

All medical and dental coverage options offered under the Plan require you to pay a monthly premium for that coverage. You may elect to pay your premiums by having the amount deducted from your check from the CTA Retirement Plan or you may pay by sending a monthly check.

If you elect to pay by sending monthly checks, you will be billed monthly, and your check must be received within 60 days of the first of the month for which you are paying. For example, if you are paying for April, Group Administrators must receive your check no later than May 30. If you miss this deadline, you and any dependents will lose eligibility retroactive to midnight on March 31. This event will count as an opt out and, if you already have opted out of coverage once, you will not be eligible to re-enroll in the Plan in the future. See the Opting Out of Coverage section for more information.

Premium Amounts

Your monthly premiums depend on how many years of service you accrued with the CTA before retiring. The longer your service, the lower your monthly premiums will be.

If you were a salaried employee of the CTA, your years of service for the purpose of determining premiums, called Premium Service, are the same as your years of Eligibility Service. See more information about determining your years of Eligibility Service.

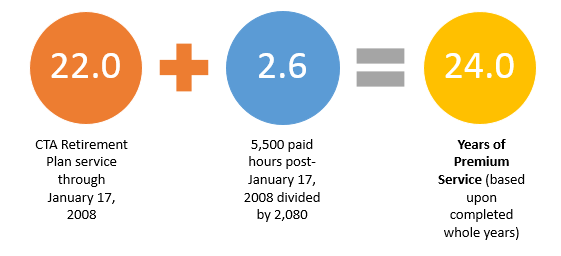

If you were an hourly employee of the CTA, your years of Premium Service and your years of Eligibility Service are measured differently. See details for information about determining your years of Eligibility Service. Your years of Premium Service equal:

- Your credited years of service under the CTA Retirement Plan through January 17, 2008;

PLUS

- The number of years resulting from dividing 2,080 into the total number of hours you worked for the CTA after January 17, 2008. That result will determine the number of years of service you have in determining what your monthly premium will be.

Premium Service is determined based upon completed full years of service, without rounding. For example, if you have 24 years and 7 months of service, your service will not be rounded up to 25 years of Premium Service.

If you worked for a period of time as an hourly employee, and a period of time as a salaried employee, then the hourly employee method is used to measure your Premium Service while you were an hourly employee, and the salaried employee method is used for the period you were a salaried employee.

You will be notified of your years of Premium Service when you apply for Plan coverage. If you are considering retiring and would like to know how many years of Premium Service you have accumulated, you may contact the Retirement Office. Contact information for the Retirement Office is provided in the Contact Information section at the end of this Summary.

Example

Jay began working for the CTA on January 17, 1985, and retired in 2011. He was an hourly employee. He accrued 22 years of credited service under the CTA Retirement Plan through January 17, 2008 (taking into account the one-year waiting period for participation). After January 17, 2008, and through his retirement in 2011, he worked a total of 5,500 paid hours. He has 24 years of Premium Service, determined as follows:

Claims Procedures

You have the right to request a review of any adverse eligibility or benefit determinations involving you or your dependents.

Type of Claim: Provision of or Payment of Benefits

If you have a claim for the provision of, or payment of, benefits for a particular type of service, drug or medical product, your claim should be submitted to the claims administrator designated by the benefit provider in the applicable Benefit Booklet. You must file the claim within the time limits and in accordance with the instructions for filing a claim. If the claim is denied, you should follow the appeal procedures described in the Benefit Booklet. If, after exhausting all available appeal procedures, the claim has not been resolved to your satisfaction, you may appeal to the Board of Trustees of the RHCT (the "Board"). See the If Your Claim is Denied section below for additional information.

Type of Claim: Eligibility and Matters Other than Payment or Provision of Benefits

If you have a claim involving eligibility, monthly premiums, enrollment elections or another matter not involving a claim for the provision of, or payment of, a benefit for a particular type of service, drug or medical product, your claim should be submitted to Group Administrators, the Plan’s third party administrator, at the address listed in the Contact Information section at the end of this Summary. For example, if you have been told that you are not eligible for coverage under the Plan and you believe that you are eligible, you should file a written claim with Group Administrators. If your claim is denied, Group Administrators will send you a written explanation that will include the specific reason(s) for the denial, based on the provisions of the Plan. The explanation also will describe any additional information you might be required to submit to complete your claim, plus a statement of why this information is needed, as well as your right to appeal the denial to the Board.

If Your Claim Is Denied

The Board will review adverse decisions made by a claims administrator concerning the provision or payment of benefits, or by Group Administrators concerning other matters. However, prior to asking the Board to review a claim relating to the provision or payment of benefits, you must have exhausted all available appeal procedures provided by the claims administrator.

Appeal Process

- To initiate an appeal to the Board, you (or your authorized representative) must submit a written request for review no later than sixty (60) days following the adverse determination that is the subject of the appeal. A late appeal may be considered by the Board if the Executive Director determines that the delay in requesting a review was due to reasonable cause.

- The request for review should be directed to the Board of Trustees of the RHCT, c/o the Executive Director, CTA Retirement Office,

55 W. Monroe Street,

Suite 1950

Chicago, IL 60603 - The request for review must include your name (and your dependent's name, if applicable), address and telephone number and a reasonable description of the adverse decision being appealed, including the date of the adverse decision. You or your authorized representative may submit written comments, documents, records and other information relating to the claim. You or your authorized representative also may request to examine any documents related to the claim.

- After a written request for review is received, the Executive Director will place the appeal on the agenda for an upcoming Board meeting.

- Following the Board's decision on the appeal, the Executive Director will communicate the decision to you or your authorized representative in writing. If the appeal is denied, the written explanation will include the specific reason(s) for the denial.

Plan Administration

Plan Administrator

The Board of Trustees of the RHCT is the Plan Administrator.

The Plan Administrator has discretionary authority to determine eligibility, benefit entitlements and adjustments, to construe the terms and conditions of the Plan and to make final and binding decisions on all matters associated with the operation and administration of the Plan. Any tribunal reviewing any decision of the Plan Administrator shall give deference to the decision of the Plan Administrator and may not disrupt any such decision unless it is determined that the Plan Administrator acted in an arbitrary and capricious manner.

Recovery of Benefit Overpayment

If any benefit paid to or on behalf of you or your covered dependent should not have been paid or should have been paid in a lesser amount and you or your covered dependent or other recipient fails to repay the amount promptly, the overpayment may be recovered by the RHCT and the Plan from any future benefits payable. The RHCT and the Plan also reserve the right to recover any such overpayment by appropriate legal action.

Information to Be Furnished

You are required to furnish to the Plan Administrator or its designee such documents, data or other information as the Plan Administrator considers necessary or desirable for the purpose of administering the Plan. The benefits payable under the Plan to you or your covered dependents are conditioned on you promptly furnishing full, true and complete documents, data or other information reasonably related to the administration of the Plan requested by the Plan Administrator or its designee.

Amendment and Termination

The Board of Trustees of the RHCT reserves the right to modify, amend or terminate the Plan at any time, except that no amendment, modification or act terminating the Plan shall be in contravention of or inconsistent with Illinois Public Act 95-0708, the legislation that established the RHCT, as amended.

Modifications to the Plan may include modifying, discontinuing or adding a particular type of benefit, adjusting the required premiums, and changing deductibles, coinsurance, co-payments, out-of-pocket maximums, annual and lifetime benefit maximums, and covered session or visit limits, and other Plan terms.

Because the Plan may be modified, amended or terminated at any time, you and your dependents do not become entitled to any vested benefits under this Plan.

Additional Plan Provisions

Subrogation and Reimbursement

The Plan is designed to help cover the actual costs you are responsible for when you or your covered dependents have a health care expense. However, you or your covered dependents may incur an illness or injury caused by the act or omission of a third party, or a third party may be responsible for payment of your health care expenses. This may occur, for example, if you are in an automobile accident. In such circumstances, you or your covered dependents may have a claim against that third party for payment of the health care expenses. A third party is any person or organization, including an insurer, other than you or your covered dependents. If you or your covered dependents are injured by a third party and if the Plan pays expenses related to such injury, the Plan, the RHCT, the HMO or the PPO, as applicable, have the right to subrogation and reimbursement, as described in the Benefit Booklets or other documents provided to you by the providers.

Lifetime Benefit Limits

The BlueCross BlueShield of Illinois PPO option places a limit on the total amount that it will pay for claims over the course of your lifetime. Expenses incurred by a PPO participant under:

- the PPO health program(s) for active CTA Employees;

PLUS - the retiree health benefits PPO program provided by the CTA Retirement Plan prior to July 1, 2009,

are aggregated, or counted together, with expenses incurred under this Plan in applying any PPO lifetime benefit limit. If you or a dependent are nearing or have reached the PPO lifetime benefit limit, you should consider enrolling in a different medical coverage option, which is not subject to any lifetime benefit limits.

Qualified Medical Child Support Orders

The Plan may be required by a qualified medical child support order ("QMCSO") to provide benefits to one or more of your dependents. Generally, a QMCSO is a medical child support order that creates or recognizes the existence of a dependent child's right to receive benefits for which you are eligible under a group health program. An order received from the government (a National Medical Support Order or Notice) will also be treated as a QMCSO. The determination of whether an order is qualified is made by the Plan Administrator or its designee pursuant to QMCSO procedures established by the Plan Administrator. You or your beneficiaries may obtain, without charge, a copy of these procedures from Group Administrators.

Continuation Coverage

Continuation coverage may be available for dependents who lose coverage under the Plan due to their ceasing to be eligible dependents. Please refer to the continuation coverage section of the provider Benefit Booklets for information. You may also contact Group Administrators for additional information. Contact information for Group Administrators is listed in the Contact Information section at the end of this Summary.

Special Rights on Childbirth

Group health plans and health insurance issuers generally may not, under federal law, restrict benefits for any hospital length of stay in connection with childbirth for the mother or newborn child to less than 48 hours following a vaginal delivery, or less than 96 hours following a cesarean section. However, federal law generally does not prohibit the mother's or newborn's attending provider, after consulting with the mother, from discharging the mother or her newborn earlier than 48 hours (or 96 hours as applicable). In any case, plans and issuers may not, under federal law, require that a provider obtain authorization from the plan or the issuer for prescribing a length of stay not in excess of 48 hours (or 96 hours).

Women's Health and Cancer Rights Act

Under the Women's Health and Cancer Rights Act, group health plans and health insurers, including HMOs, that provide medical and surgical benefits for mastectomies generally must provide coverage for the following if a covered individual elects breast reconstruction in connection with a mastectomy:

- Reconstruction of the breast on which the mastectomy has been performed;

- Reconstruction of the other breast to produce a symmetrical appearance; and

- Prostheses and treatment of typical complications relating to the mastectomy, including lymphedemas.

This coverage is subject to copayment and other provisions generally applicable to other medical and surgical benefits.

Early Retiree Reinsurance Program

The Plan is certified for participation in the Early Retiree Reinsurance Program. The Early Retiree Reinsurance Program is a Federal program that was established under the Patient Protection and Affordable Care Act. Under the Early Retiree Reinsurance Program, the federal government reimburses a plan sponsor of an employment-based health plan for some of the costs of health care benefits paid on behalf of, or by, early retirees and certain family members of early retirees participating in the employment-based plan. By law, the program expires no later than January 1, 2014.

Under the Early Retiree Reinsurance Program, the RHCT may choose to use any reimbursements it receives from this program to reduce or offset increases in plan participants' premium contributions, co-payments, deductibles, coinsurance, or other out-of-pocket costs. If the RHCT chooses to use the Early Retiree Reinsurance Program reimbursements in this way, you, as a plan participant, may experience changes that may be advantageous to you in your health plan coverage terms and conditions, for so long as the reimbursements under this program are available and the RHCT chooses to use the reimbursements for this purpose. The RHCT may also use the Early Retiree Reinsurance Program reimbursements to reduce or offset increases in its own costs for maintaining your health benefits coverage, which may increase the likelihood that it will continue to offer health benefits coverage to CTA retirees and employees and their families.

General Plan Information

| Name of Plan: | Chicago Transit Authority Retiree Healthcare Plan |

|---|---|

| Plan Type: | The Plan is a welfare benefit plan for retired employees offering medical, dental and prescription drug coverage. |

| Benefit Providers: | See the Enrollment Guide, which is available at www.ctaretirement.org or by calling Group Administrators at 1 866 997 3821. |

| Contribution Sources: | The cost for Plan coverage for you and your covered dependents is paid in part by the CTA RHCT and in part by you. The CTA RHCT is funded on an ongoing basis by CTA employee and retiree contributions. The monthly premiums you must pay are adjusted from time to time by the Board of Trustees. The current schedule of premiums can be found in the Enrollment Guide posted on www.ctaretirement.org. |

| Plan Sponsor: | Chicago Transit Authority Retiree Healthcare Trust 55 W. Monroe Street, www.ctaretirement.org |

| Plan Sponsor's Federal Tax ID Number: | 30-0497695 |

| Plan Administrator: | Board of Trustees Chicago Transit Authority Retiree Healthcare Trust 55 W. Monroe Street, |

| Plan Year: | January 1 through December 31 |

| Agent for Service of Legal Process: | Chicago Transit Authority Retiree Healthcare Trust |

| Attention: | General Counsel 55 W. Monroe Street, |

Contact Information

If you have questions about your benefits or wish to file a benefit-related claim, please contact the appropriate benefit provider. If you have questions concerning eligibility for Plan coverage, monthly premiums or other matters, please contact:

915 National Parkway, Suite F

Schaumburg, IL 60173

(866) 997-3821

55 W. Monroe Street,

Suite 1950

Chicago, IL 60603

(866) 441-9694